Tuesday, January 19 at 2:00 p.m. ET Hear from Gregory Furer, CEO of Beratung Advisors, as he shares his method for building and presenting financial plans in a way that supports the type of client experience that helped Beratung grow their AUM by 500%. However, in the financial technology market, free can actually offer great value and is worth considering as investors. Robo advisors are companies that have married technology with financial advice to offer investors fully automated portfolio management services at a fraction of the cost of traditional investment management firms.

Having a plan for your finances is crucial, and a comprehensive financial plan may include budgeting, saving, investing, paying off debt and creating a roadmap to retirement. Working with a financial advisor can be helpful in creating your personal money plan, but DIY types might prefer to use a financial planning software instead. There are a multitude of options to choose from and each one has a different range of features. If you’re a financial advisor yourself, there are also plenty of software options that you can use to help you build plans for your clients.

Financial Planning Software for Individuals

Personal Capital

| Fees | – Free |

| Best For | – Those who want to integrate their investing needs with a financial plan |

Personal Capital is a popular financial planning software option for both beginners and those more experienced with money management. The free version of the software includes all the features necessary for basic financial planning, including:

- The ability to link all of your financial accounts, including retirement and investment accounts, in one place

- A “net worth” tracker

- A tool to find hidden fees you might be paying for your investments

- Budgeting and cash flow tools to track spending

- Goal trackers for your spending and savings targets

- Tools for forecasting retirement and college savings outcomes

These features are included in the software at no charge and offer a comprehensive view of your finances. If you need help choosing investments, Personal Capital also offers robo-advisor wealth management services for a fee.

Quicken

| Fees | – Plans start at $34.99 |

| Best For | – Users looking for a simple software |

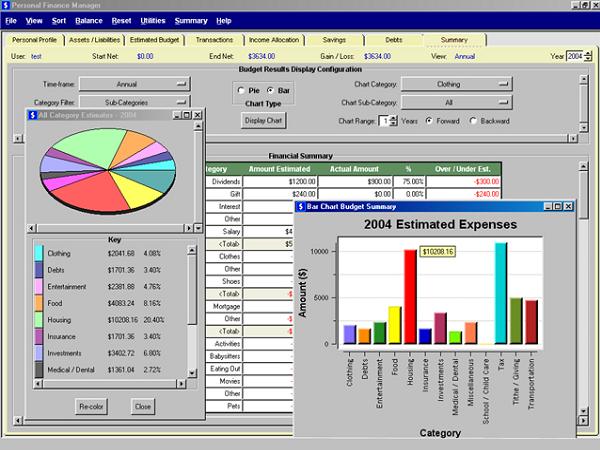

Quicken offers multiple financial planning software solutions, depending on what exactly you want to do with your money. The Starter version, for example, lets you view all of your accounts in one place, create a budget, track your spending, manage your bills and categorize your purchases.

If you want to take a deeper dive into your finances, the Premier version may be more appropriate. This version lets you do everything the Starter version does, while also adding in some additional features and tools, such as:

- The ability to track loans, investment and retirement accounts in one place

- Access to Morningstar’s® Portfolio X-ray® tool

- Automatic bill pay

- Market comparison and investment tax planning tools

There’s also the Home & Business version, which might be helpful if you need a streamlined way to manage business and personal finances.

Intuit Mint

| Fees | – Free |

| Best For | – Existing Intuit customers – Anyone with multiple bank accounts |

Mint is one of the most popular free financial planning tools on the market. There’s a lot you can do with Mint, including:

- Tracking all of your bank and credit card accounts in one place

- Setting your monthly budget

- Tracking and categorizing expenses

- Monitoring your credit score

- Tracking your investments

- Setting up bill pay reminders

“Mint is an incredibly popular online personal finance tool that’s great for all kinds of users. Aside from it being a great budgeting tool, it has a plethora of money management tools that you can also use,” says Brian Meiggs, founder of millennial finance site MyMillennialGuide.com.

Mint is more focused on basic budgeting and money management than it is on investing. You also can’t pay your bills through the software. Still, it’s got a good user interface that’s easy to navigate, and it’s great for users who are mainly interested in tracking their spending and keeping on budget. The app works on both mobile and desktop, so it might also be good for someone who wants to manage their finances on the go.

WealthTrace

| Fees | – $229 to $309 for first year – $169 to $269 for renewal |

| Best For | – Those looking for more in-depth analysis – Smaller advisory firms that want plenty of support |

WealthTrace is a financial planning program that both individuals and advisors can use. Individual users can choose from three package tiers: Basic, Advanced and Deluxe. The cost of the software ranges from $229 to $309 for the first year, with lower rates for subsequent annual renewals.

What WealthTrace offers in exchange for these prices is the ability to budget your money and set specific savings goals. You can plan for both retirement and college savings, as well as attain some insight into how to minimize your tax liabilities.

Like some of the advisor-focused programs on the market, WealthTrace also allows you to run scenarios on things like market downturns, life insurance needs and retirement income. If questions come up as you use the program, you can connect with a WealthTrace expert by phone, email or live chat to get help.

Financial Planning Software for Financial Advisors

MoneyGuidePro

| Fees | – $50 to $175 per advisor, per month – $500 to $2,000 per advisor, per year – $400 to $660 per year for various add-ons |

| Best For | – Solo financial planners – Individual RIAs |

MoneyGuidePro is a client-centered financial planning software used by professional financial advisors. It’s focused on alternatives to the standard methods of retirement planning. One of the features that’s integrated within this software is called Play Zone, which utilizes sliders for retirement age, financial goals and more to illustrate how financially successful a client’s retirement could be.

This software comes in three forms: One, Pro and Elite. One is the most basic version, as it comes with a risk tolerance assessment tool, financial and lifestyle goals planning and more. Pro boasts all of the features of One, as well as a bunch of extras, like risk management, estate planning and Social Security optimization. The Elite edition offers everything, in addition to secure income modeling, total income modeling and advanced lifetime protection.

In March 2019, Envestnet purchased MoneyGuidePro for $500 million and took over its operations. Envestnet is a large financial services company that focuses on various advisor-centric wealth management platforms.

eMoney Advisor

| Fees | – Varies depending on the needs of the advisor or firm |

| Best For | – Firms looking for a complete set of advisory services and programs |

eMoney Advisor offers a hefty suite of financial planning services for advisor firms and large advisory enterprises. The program is based around three distinct packages of services (Plus, Pro and Premier), with a fourth tier reserved for customized enterprise relationships.

Customers who purchase the Plus tier receive bare-bones access to eMoney’s customer website and mobile app, foundational financial planning services and advanced financial analytics. If you need more than that, the Pro version upgrades the basic foundational financial planning services for an advanced level, in addition to advanced financial analytics. Premier customers gain access to everything that eMoney has to offer.

eMoney Advisor can be integrated with other popular advisory services from Morningstar, Salesforce, Fidelity, Envestnet and more.

Money Tree

| Fees | – $495 to $1,345 per advisor, per year |

| Best For | – Multi-advisor firms |

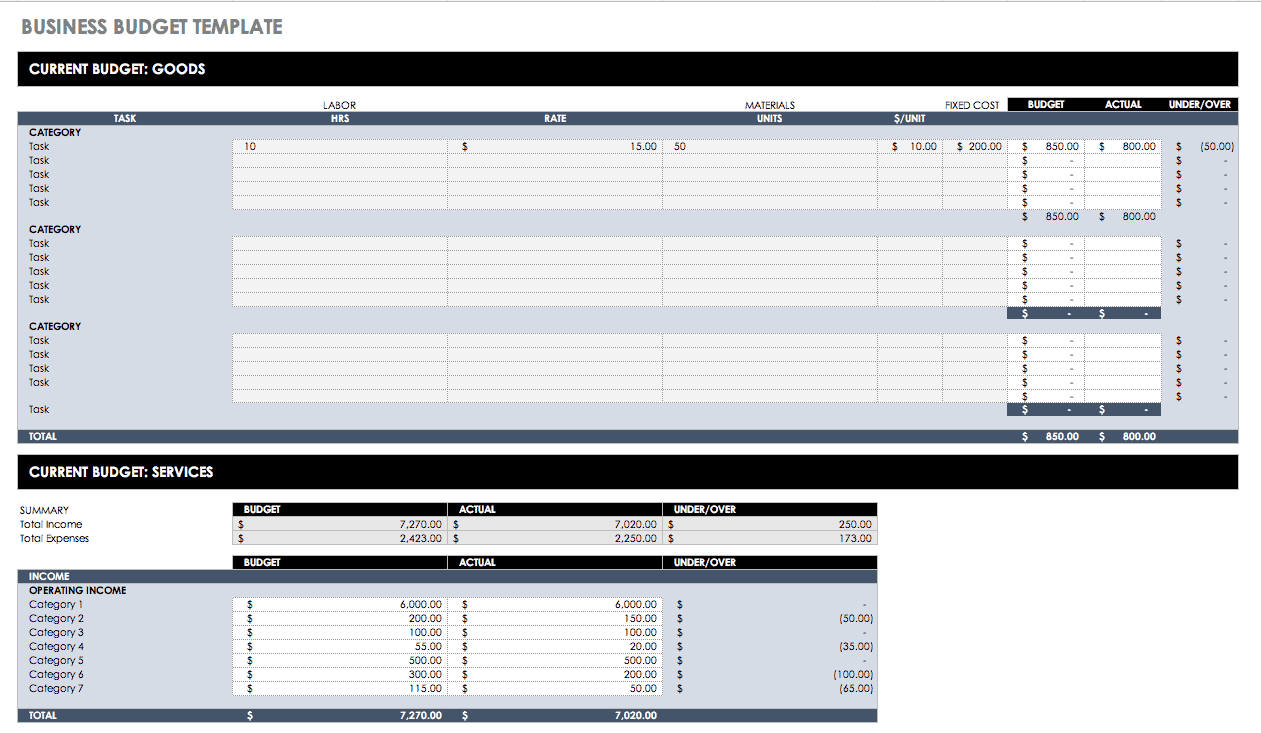

Money Tree is an advisor platform that uses a three-pronged approach to financial planning. The software allows advisors to complete a big picture, in-depth and advanced cash flow analysis for their clients.

With Money Tree, advisors can create a financial plan independently of, or in collaboration with, their clients. The software also features an interactive tool that allows advisors to quickly and easily run “what-if” scenarios to determine different outcomes. The program’s design is also capable of helping advisors pinpoint the potential shortfalls in their clients’ financial plans and find solutions for closing the gap.

RightCapital

| Fees | – Basic tier: $124.95 per advisor, per month – Premium tier: $149.95 per advisor, per month – Platinum tier: Call for pricing |

| Best For | – Larger financial planning and wealth management firms |

Advisors can use RightCapital to develop financial plans through an innovative platform. It’s the software Jason Ball, a CFP at Ball Comprehensive Planning in West Linn, Oregon, uses for his clients. What he likes best about the software is its “ability to integrate accounts, client vaults and strategic tax planning for retirement planning.”

RightCapital also offers a mobile-friendly user-interface, which tech-savvy advisors may appreciate. The inclusion of tax planning tools is one of the most important things that sets the software apart from its competitors.

Bottom Line

/ynab4_report_spending_category-59c0304f03f4020010c447cd.jpg)

Whether you do it yourself or work with an advisor, it’s important to build a comprehensive financial plan. Fortunately, there are several online services that make it easier to build a financial plan and track your saving and spending.

Before you make a firm decision as to which software you want to partner with, it might be worth writing down what goals you want to plan for. By doing this, you can ensure that the benefits of whatever software you select align perfectly with your overall needs.

Financial Planning Tips

- Consider working with a financial advisor to build a financial plan that’s tailored to your life. While financial planning software can help you get control of your money, it’s not a complete substitute for the human touch. SmartAsset’s advisor matching tool can connect you with up to three suitable advisors in your area. Get started now.

- Before selecting a financial planning software, assess your needs. For instance, are you looking for a program that focuses on weekly and monthly budgeting? Do you need something that includes long-term retirement planning and other tools to help you grow your wealth? The answers to these questions will lead you to the best options for you.

Photo credit: ©iStock.com/dusanpetkovic, ©iStock.com/Jirapong Manustrong

2020-09-09 18:13:12 • Filed to: Business Tip • Proven solutions

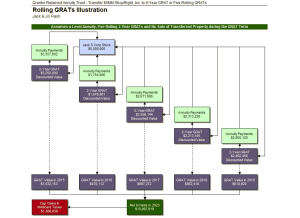

Financial planning is an essential for nearly every aspect of your life. From estate management, college and education planning, generational wealth transfer to retirement planning, each aspect of life requires quite a bit of financial planning. While most people will hire a financial advisor to help them in this regard, it is important to note that thee financial advisors have to employ the services of financial planning software to keep track of all the necessary components of successful financial planning.

In this article, we are going to be looking at the top 5 financial planning software that the top financial advisors use.

Top 4 Financial Planning Software

1. eMoney Advisor

This is financial planning software that specializes in the creation of digital advisory software and platforms for financial advisors. It was created in 2000 by a financial advisor who wanted to create a single practice management tool that made financial advisory that much more efficient. Among other features, eMoney Advisor provides goal-based planning focusing on each client's individual needs, aggregated accounts, advanced planning, cash flow management, retirement planning and estate planning.

Pros:

- It was designed by a financial advisor and so understands the needs of all financial advisors

- Has great analytics and metrics to make financial planning easier

Cons:

- It does have a free trial, although it is limited in its capabilities

2. Finance Logix

Free Financial Advisor Services

Finance Logix is a financial planning program that focuses on client participation in all aspects of financial planning. It boats some of the top banks and investment brokerage firms as clients. Among other features it offers retirement planning, insurance planning, education planning, estate planning, asset allocation, cash flow analysis and goal-based planning.

Free Online Financial Advisor

Pros:

- It comes with a client portal that makes client participation easier

- All data is secured using the latest in online security protocols

Cons:

- It can be a little bit difficult to set up

3. Money Tree Software

This is another financial planning software that was founded by financial advisors. It empowers advisors with all the tools and features that are necessary to navigate an ever-changing and growing industry. It is divided into two individual primary software, Silver Financial Planner and Total Planning Suite. Both programs are meant to tackle various areas of the financial planning process and they collectively tackle retirement planning, education planning, insurance needs, cash flow analysis and even goal oriented planning.

Pros:

- It covers all aspects of financial planning

- It integrates with third-party programs

Cons:

- The different software in one suite can be a little bit overwhelming

4. MoneyGuidePro

If you are looking for a web-based financial planning software, MoneyGuidePro is the best solution for you. established in 1985, it is one of the oldest software in the business and as such offers a wealth of experience when it comes to financial management solutions. It has created over 6 million plans for different clients in its lifetime with different features that tackle education planning, health planning, retirement planning and many others.

Pros:

- It is online bases and thus makes for easy sharing

Cons:

- At an average price of $1295, it can be a bit expensive to set up

Tips for Using Financial Planning Software

The following are just some tips to make finding and using financial planning software that much easier for you.

- Find the financial planning software that specializes in the kind of financial planning you want to do. For example, find a program that focuses on education panning if you want to save up some money for your child's college fund.

- Decide if you want a desktop based program or an online based one. Again, this decision will depend on the kind of financial planning you want to accomplish and the sensitivity of the information.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Best Financial Advisors Reviews

Buy PDFelement right now!